What Are NFTs?

Non-Fungible Tokens (NFTs) have redefined digital ownership—offering a way to buy, sell, and authenticate unique digital assets on the blockchain. Here, we break down what NFTs are, how they work, and why they’ve become a cultural and economic phenomenon.

1. What Does NFT Stand For?

NFT means Non‑Fungible Token.

- Fungible means something that can be swapped — like cash or Bitcoin, where each item is identical in value.

- Non‑fungible, by contrast, refers to something unique and irreplaceable—like a painting or a concert ticket.

So, an NFT is a unique digital token stored on a blockchain that serves as a certificate of authenticity and ownership for a specific digital (or sometimes physical) item.

2. How Do NFTs Actually Work?

- NFTs are digital records (tokens) on blockchains like Ethereum, Solana, and others.

- Each NFT follows certain standards—most commonly ERC‑721 or ERC‑1155—which make sure each is unique and can be transferred between wallets.

- When you “mint” an NFT, you link digital content (like art or music) to your token and record that on the blockchain.

- The blockchain keeps a transparent history of ownership—so anyone can verify who owns what.

3. Why Do People Value NFTs?

Uniqueness and Scarcity

- Digital Scarcity and Limited Editions

NFTs are deliberately issued in limited quantities—ranging from one-of-one pieces to limited-run editions—which imparts rarity and collectible appeal. For instance, CryptoPunks remain valuable because they are entirely unique and one of the earliest NFT projects. - Verifiable Authenticity and Provenance

The blockchain records each NFT’s origin and entire ownership history in an immutable, transparent ledger—offering indisputable proof of authenticity and enhancing trust. - Economic Effects: Bandwagon and Snob

Research indicates that NFT value is influenced by two simultaneous forces:- Bandwagon effect: Popular collections attract more buyers, boosting value.

- Snob effect: Within those collections, rarer tokens attract those looking for exclusivity.

The combination of these effects contributes significantly to how NFTs are valued socially and economically.

Royalties and Smart Contracts

- Automated Resale Royalties for Creators

Creators can embed royalty terms into NFTs via smart contracts. Whenever an NFT is resold on a supporting marketplace, a fixed percentage automatically returns to the creator—providing an enduring income stream.- Examples: Beeple earned 10% when his Crossroads NFT resold for $6.6M; Yuga Labs receives a 2.5% royalty on Bored Ape sales.

- Transparency and Reduced Intermediaries

The royalty mechanics are transparent and automatic, removing payment delays and minimizing reliance on intermediaries like galleries or agents. - Practical Limitations

It’s important to note that royalties aren’t guaranteed if sales occur on platforms that don’t enforce them. Creators often rely on popular marketplaces (like OpenSea or Rarible) that support these smart-contract royalties.

Access and Perks (Utility)

- Memberships, Passes, and VIP Access

Many NFTs serve as digital access keys, granting holders entry to exclusive communities, events, or physical and virtual experiences.- The Bored Ape Yacht Club pioneered this model, offering members access to exclusive gatherings and merch.

- GQ’s GQ3 Issue 001 NFT collection provided holders with ongoing access to events, swag, and content.

- Brand Collaborations and Real‑World Benefits

Brands are using NFTs to offer tangible perks: - Token-Gated Commerce and Rewards

NFTs are increasingly acting as membership cards, unlocking token-gated access to early product drops, special discounts, or co-creation opportunities. While many of these initiatives made headlines, some were time-limited or experimental in nature:- Starbucks Odyssey (Concluded): Starbucks launched its NFT-powered loyalty program in 2022, offering customers “stamps” that unlocked special experiences and rewards.

- Lacoste UNDW3 (Previously Active): Lacoste’s NFT initiative invited holders to participate in design contests, gated digital spaces, and early product access.

- Adidas × BAPE (Limited Drop): In 2023, Adidas and BAPE released a one-time drop of physical sneakers paired with NFT “digital twins.”

- Coca‑Cola, Dolce & Gabbana, and Others (Past Campaigns): These brands experimented with NFT collections that merged digital collectibles with physical merchandise or virtual experiences. Most were limited-time campaigns rather than sustained loyalty programs.

- Broader Use Cases and Utility Value

Beyond exclusive access, NFTs can serve broader practical functions, such as virtual land, in-game items, or as loyalty tokens. This combination of exclusivity and utility contributes to their appeal.

4. What You Can Actually 'Own'

- You own the token, not necessarily the artwork's intellectual property. For example, you own a certificate of authenticity, but copying the file doesn’t change that. As Elite Business Magazine clarifies: “An NFT buyer does not obtain automatic ownership of any underlying asset… IP rights do not automatically transfer to the buyer” unless the smart contract or terms explicitly provide for that.

- The digital file is usually stored elsewhere (not on the blockchain), so if the file disappears or the link breaks, your NFT may lose its value.

- Licenses tied to NFTs differ widely. In most cases, purchasing an NFT confers only a personal, non-commercial use license—allowing display on platforms like social media or private collections, but not broader usage. Commercial rights, such as reproducing or creating derivative works, usually remain with the creator unless explicitly granted.

5. Watch Out: The Risks and Criticisms

Not Full Ownership

- Token ≠ Content Ownership

Owning an NFT means you possess a unique token recorded on a blockchain—but this does not confer copyright or legal ownership of the actual digital asset. Most NFTs only grant a token-based license, not intellectual property rights. - Misleading Messaging from Issuers

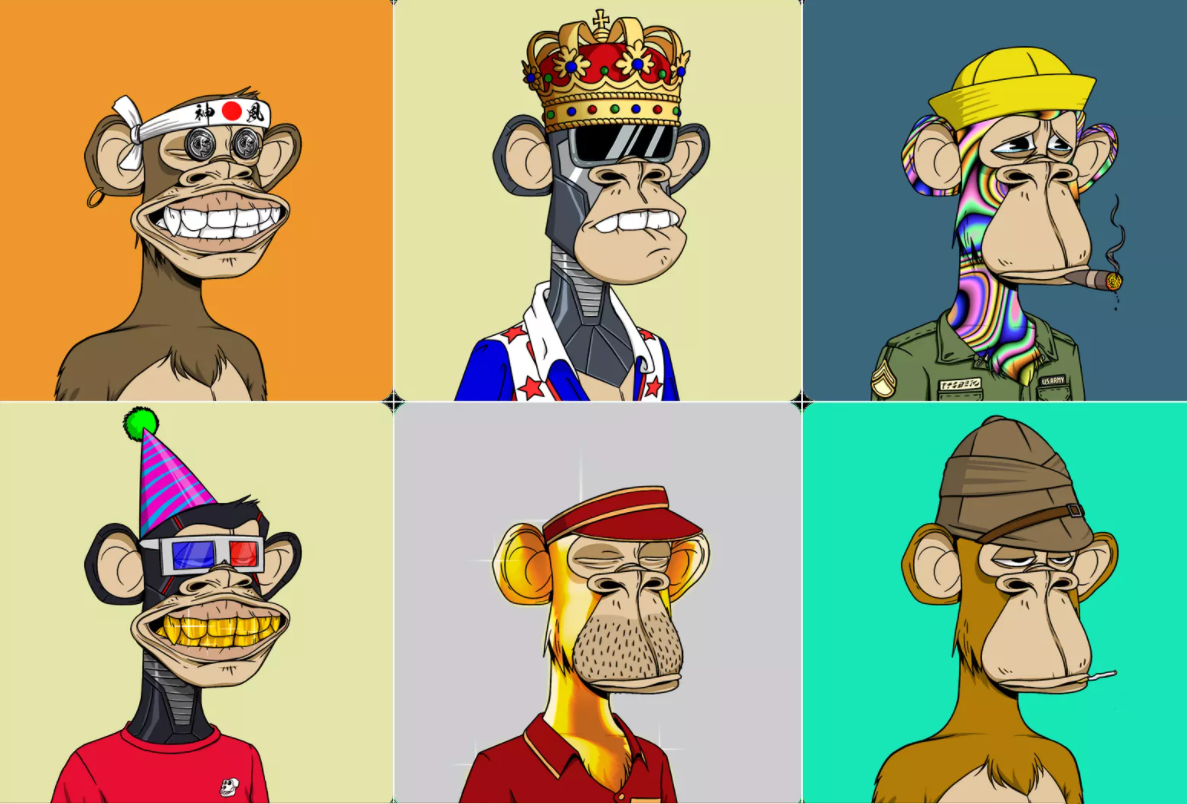

Some projects, like the Bored Ape Yacht Club, have created confusion with language suggesting full ownership of the art—when in reality, only a license is being granted.

Technical Fragility: Link Rot and Storage Risks

- External File Dependencies

Many NFTs simply link to media hosted off-chain. If that host goes offline or changes, the NFT may point to a dead or broken link—known as “link rot”. - Decentralized Storage is not Universal

While systems like the InterPlanetary File System (IPFS) can help preserve files, they require “pinning” services or nodes—otherwise, the NFT’s content may become inaccessible. - Impermanent Metadata

One study found that nearly 45% of ERC‑721 NFTs (Ethereum standard) lacked permanence in their metadata—raising red flags about their long-term viability.

Marketplace Fees and Transaction Costs

- Gas Fees Can Outsize the Sale

On blockchains like Ethereum, fees (known as “gas”) fluctuate with network demand. On busy days, fees can exceed the value of the NFT itself. - Marketplace Profits vs. Artist Earnings

Experts warn that platforms and exchanges often make the biggest margins—from gas, listing, and secondary sale fees—while artists and creators may see minimal returns after costs.

Scams, Frauds and Fake Projects

- Pump-and-Dump, Rug Pulls, and Manipulation

Scammers frequently hype obscure NFT projects, inflate prices via coordinated buying (“pump-and-dump”), and then disappear, leaving buyers with worthless tokens. - Phony Platforms and Counterfeits

Fake websites mimicking legitimate marketplaces, as well as impersonated or plagiarized NFTs, are common vectors for fraud. - Insufficient Regulation

The NFT market operates with limited oversight, making it vulnerable to scams, wash trading, and market manipulation. - Bot Activity and False Engagement

Fraudulent promotion campaigns, often driven by bots, inflate hype for fake NFT collections—misleading genuine buyers.

Value Volatility and Financial Risk

- Rapid Depreciation

NFT values are notoriously volatile. Many NFTs lose value quickly once market hype fades—making them a high‑risk asset. - High Failure Rate of Collections

A report cited that over 95% of NFT collections have zero monetary value, underscoring how rare long-term success truly is. - Psychological and Social Hype Effects

Market dynamics often favour speculative behavior—whales driving demand, celebrity hype, or influencer endorsements—rather than intrinsic value.

NFTs offer innovative ways to trade and collect digital assets—but they also introduce significant risks. Misconceptions about ownership, technical vulnerabilities, financial costs, and a largely unregulated market mean that caution and thorough research are essential before engaging.

6. Real‑World Examples of NFTs

NFTs have moved beyond niche communities into mainstream culture, with artists, brands, and collectors using them in innovative ways. From digital art and fashion to exclusive memberships and branded collectibles, these examples show how NFTs are being applied in practical, high-impact contexts.

CryptoPunks: Digital Groundbreakers in Pixel Form

Created by Larva Labs in 2017, are often celebrated as the first major NFT project on Ethereum—comprising 10,000 algorithmically generated, uniquely styled 24×24 pixel characters. Each Punk's rarity and individuality helped establish them as cryptographic collectibles and cultural status symbols.

Some sales underscore their high value:

- CryptoPunk #5822 (“Alien” type) fetched around $23.7M

- #7523, “COVID Alien,” sold for approximately $11.75M

- #3100, notable for its blue-and-white headband, went for $7.6M+

Bored Ape Yacht Club (BAYC): Avatars That Build Community

BAYC introduced 10,000 unique cartoon ape avatars in 2021. Beyond NFTs, each ape serves as a membership token to an exclusive club—granting access to events, merch, and community-driven activities. Owners even receive commercial rights to utilize their ape's likeness in their own projects.

The project emphasized identity and community: the Bored Ape avatar became a recognizable social signal on platforms like Twitter, transforming ownership into digital identity and status.

High‑Value Digital Art: NFTs That Grab Headlines

NFTs of digital art have made headlines with jaw-dropping auction results:

- "Everydays: The First 5000 Days" by Beeple sold for approximately $69.3 million at Christie’s—the most expensive NFT ever recorded.

- Beeple’s "Human One", a hybrid physical-digital kinetic sculpture, fetched around $28.9 million.

- Other remarkable sales include Pak’s "The Merge" at $91.8M, and "Clock" (by Pak & Assange) at $52.7M.

- Notably, even memes have broken through: the "Disaster Girl" meme sold as an NFT for nearly $500,000.

- Grimes’ WarNymph digital artworks brought in over $5.8M in under 20 minutes.

These record-breaking transactions showcase NFTs as serious art-market disruptors.

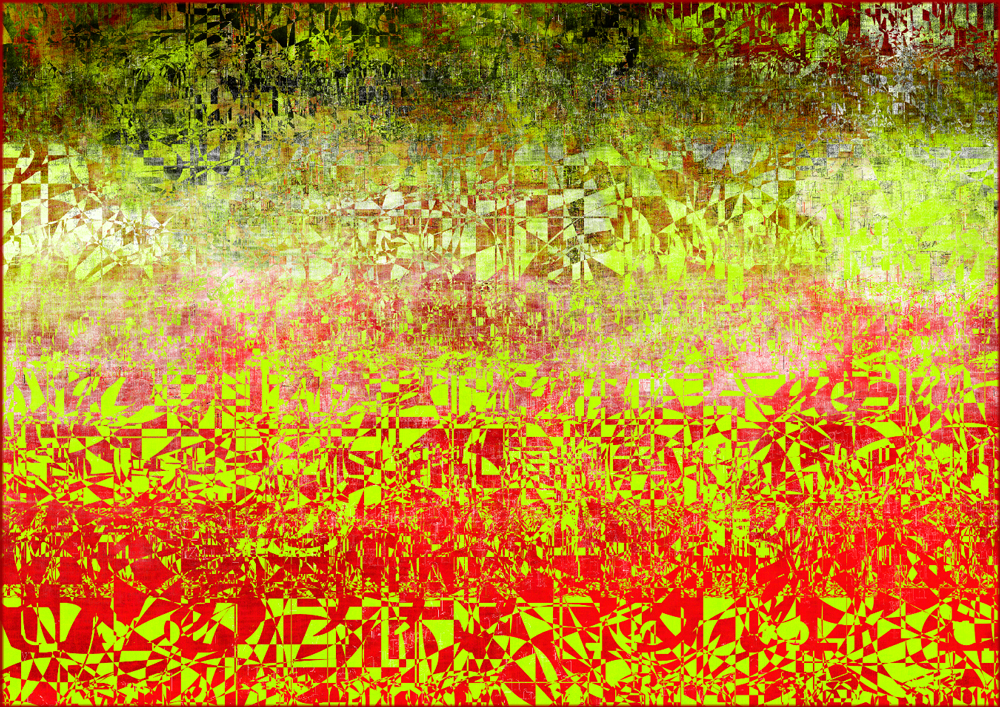

Mixed Styles: A Glimpse of the NFT Landscape’s Diversity

NFTs have expanded far beyond avatars and pixel art, covering diverse creative expressions:

- Digital Fashion and Wearables: Virtual clothing and fashion pieces—sometimes tied to real-world perks—add style to digital identities.

- 3D Designs and Sculptures: Beeple’s Human One and other dynamic digital-physical hybrids bring immersive experiences into collectors’ hands.

- Illustrations and Meme Culture: From emotive digital drawings to iconic memes like Disaster Girl, the spectrum includes both high art and community-driven viral icons.

- Experimental Art: Animated GIF artworks, such as XCOPY’s Right‑click and Save As Guy, exemplify niche digital artistry.

An introduction to NFTs (Non-Fungible Tokens), exploring how they function, what distinguishes them from traditional cryptocurrencies, and their role in digital ownership and blockchain technology

Final Thoughts

NFTs are more than just digital collectibles or internet hype—they represent a fundamental shift in how we define ownership, creativity, and identity in the digital age. Whether applied to art, fashion, gaming, or community building, NFTs open new doors for creators and audiences to interact directly, transparently, and often with programmable utility. But with this innovation comes complexity: legal ambiguity, environmental concerns, and volatile markets all challenge the narrative. As the technology evolves, so too will its meaning and impact—making NFTs a space to watch, question, and perhaps one day, actively shape.