2.1 Understanding Distributed Ledgers and Blockchain

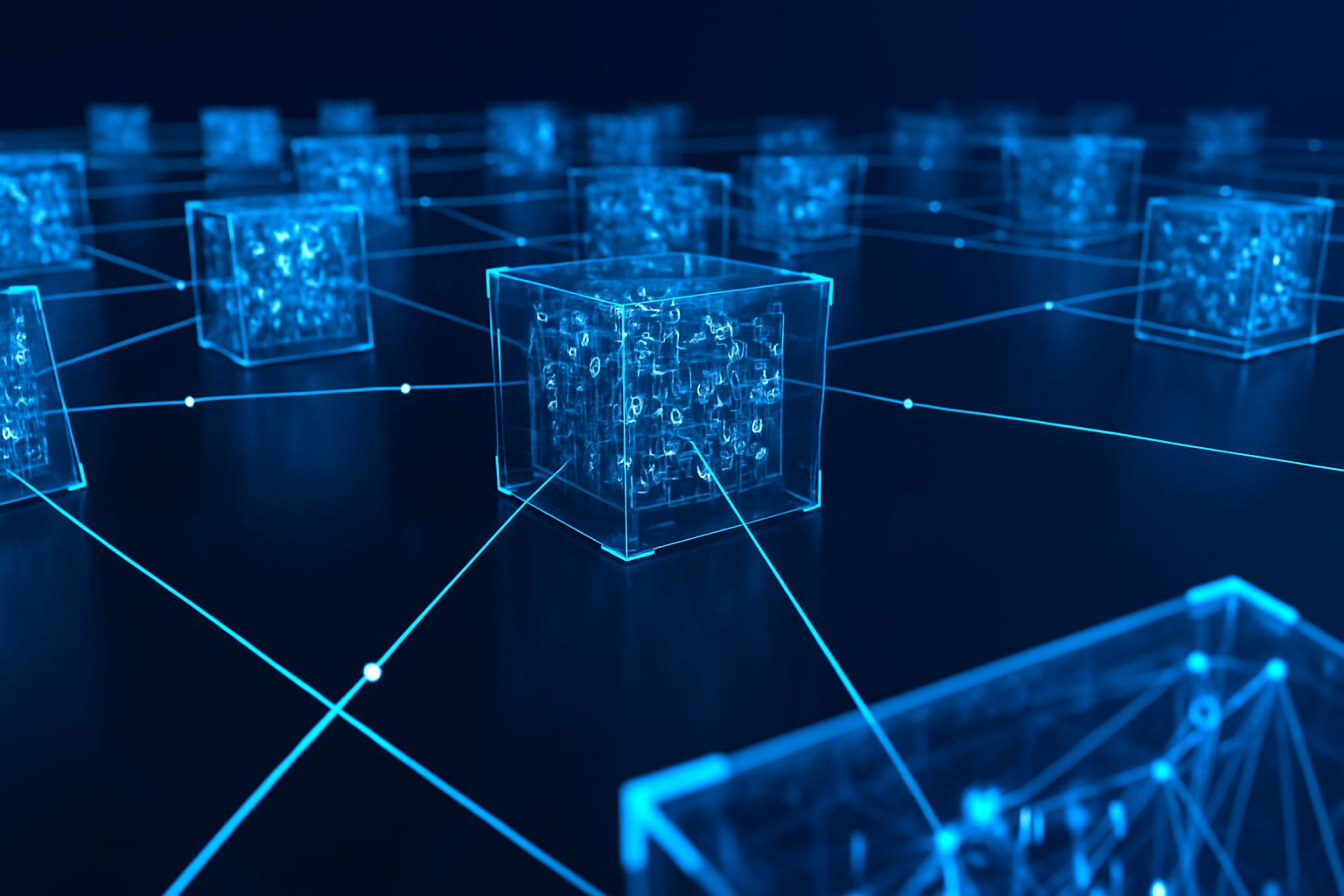

Blockchain is best understood as a distributed ledger–a database of transactions that is shared and synchronized across many computers (nodes) worldwide. Unlike a traditional centralized ledger (e.g. a bank’s database), every participant (node) in the network maintains a copy of the entire ledger. When a new transaction occurs, every node validates and records it in their copy of the ledger. This means there is no single “master” copy owned by one authority: instead, trust comes from the collective consensus of the network. In effect, the blockchain “disrupts how databases get synchronized”, ensuring there is always one agreed version of the truth.

Because every node can access the same ledger simultaneously, blockchain has been compared to a shared Google Doc for transaction records. In that analogy, multiple people can view and edit one document at the same time, and everyone sees the same updated version. A blockchain works similarly: the distributed network of computers ensures that every participant sees the same transaction history, avoiding conflicting copies. In technical terms, blockchain data is “distributed” (across nodes) and “decentralized” (not controlled by any single entity). This foundational feature—where any attempted alteration on a single node is automatically spotted and discarded because it doesn’t align with the rest of the network—lays the perfect groundwork for understanding how blockchain transforms everyday business challenges.

Analogy 1: Blockchain as a Global Certificate Vault for Digital Assets

Imagine an international art fair where anyone can create, buy, or sell digital art. But unlike physical paintings, these artworks exist only online—so how do you prove who made them, who owns them now, and whether the version you’re looking at is the original or just a copy?

Now imagine that every piece of art comes with a certificate of authenticity that’s recorded in a tamper-proof global registry. This registry is public, and every entry is time-stamped, traceable, and cryptographically secured. Even if someone screenshots the artwork or shares it online, only the person holding the original certificate in the registry can claim ownership—and sell it.

This is exactly how NFTs work using blockchain.

For example, when an artist mints a digital artwork as an NFT on the Ethereum blockchain, they are creating a unique token that links to that artwork. This token acts like a digital deed of ownership—recording the creator, timestamp, and all subsequent transactions (e.g. sales or transfers). Platforms like Foundation, Zora, and SuperRare rely on this system to verify provenance and enable resale, while artists can even program royalties directly into the smart contract, receiving a cut every time the piece is resold.

So in the NFT ecosystem, blockchain doesn’t just move money—it functions as a transparent, decentralized registry of originality, ownership, and value in the digital world.

Analogy 2: Blockchain as an International Digital Highway With No Toll Booths

Suppose you're shipping goods across multiple countries. Traditionally, each border crossing requires stopping at a checkpoint: documents are inspected, fees are paid, and delays are common. The longer the route and the more countries involved, the slower and more expensive the process becomes.

Now apply that same idea to sending money internationally. In the traditional financial system, a cross-border payment has to pass through several intermediaries—banks, clearing houses, and currency exchanges—each taking time and fees. Transfers can take days, and hidden costs often stack up.

Blockchain-based crypto payments replace this entire system with something more like a dedicated high-speed highway—a direct path between sender and receiver with no toll booths, no border checks, and no unnecessary delays.

When someone sends crypto like USDC or Solana (SOL), the transaction doesn’t wait for bank hours or international settlement systems. It’s processed by the blockchain network 24/7, confirmed in minutes or seconds, and recorded immutably for both parties to see. No intermediaries are needed, and fees are often a fraction of what traditional systems charge.

This is why companies like Ripple, Stellar, and Lightning Network (on Bitcoin) are building crypto payment infrastructure: to create a real-time, global financial highway that lets money move as fast as the internet itself—regardless of borders, bank holidays, or business hours.

Analogy 3: Blockchain as a Trustless Escrow Agent in a Digital Marketplace

Picture an online marketplace where two people—one selling a digital service (like graphic design) and one buying it—agree on a deal. In traditional systems, a platform like Fiverr or Upwork sits in the middle: it holds the buyer’s payment in escrow and releases it to the seller once the work is delivered. The platform charges a fee for this role and must be trusted to act fairly.

Now, imagine replacing that centralized platform with a self-executing agreement written directly into code—a smart contract on a blockchain.

In the world of crypto, this is exactly what happens. The buyer’s funds are locked in a smart contract when the agreement is made. Once the seller delivers the work and meets the conditions written into the contract (for example, submitting a file or reaching a deadline), the contract automatically releases the funds—no human, no company, and no third-party intermediary required.

Overcoming Financial System Challenges with Blockchain

The following table highlights the limitations of conventional financial systems and demonstrates how blockchain technology provides innovative solutions:

| Challenge in Traditional Systems | How Blockchain Helps |

|---|---|

| Fragmented records, frequent disputes | Shared immutable ledger ensures all participants see the same information, fostering trust without a central authority. |

| Slow, costly reconciliation | Continuous, real-time updates with automated compliance controls embedded in the ledger. |

| Fraud and tampering | Cryptographic security, audit trails, and uneditable entries safeguard data integrity. |

| Manual contracts and claims | Self-executing smart contracts automate actions and enforce terms once predefined conditions are met. |

| Complex audits | Seamless, continuous auditability and compliance tracking streamline oversight. |

| Limited traceability (e.g. in crises) | Rapid tracing of products with full provenance, reducing costs and speeding up processes. |

The key takeaway from the analogies shared is that blockchain functions like a public ledger that everyone in the network shares and updates collectively. It is built to be tamper-proof, transparent, and decentralized, ensuring that no single person or institution holds exclusive control over the records. Instead of placing trust in a central authority, trust is distributed—rooted in the system’s rules and the consensus of its participants. While blockchain is often associated with digital currencies, its design makes it well-suited for any use case that requires verifiable, secure record-keeping—including property ownership, legal contracts, identity management, and more.

Now that we've explored what a distributed ledger is and how blockchain technology creates a secure, decentralized record of transactions, it's time to take a closer look at the core components that make it all work. In the next lesson, Blocks—The Building Units of the Chain, we’ll break down the structure and function of individual blocks—how they store data, link together, and form the backbone of the blockchain system.