3.3 Mining Dynamics: Global Hashrate Distribution and Sustainability

Bitcoin mining secures the network and creates new coins, but its global distribution and environmental impact are critical areas of focus.

Mining Overview

Bitcoin mining is the backbone of the Bitcoin network, responsible for both creating new bitcoins and verifying transactions. Miners use specialized hardware, primarily Application-Specific Integrated Circuits (ASICs), to solve complex cryptographic puzzles in a process called Proof of Work (PoW). The first miner to solve the puzzle adds a new block to the blockchain, earning a reward of newly minted bitcoins and transaction fees. As of 2025, the block reward is 3.125 BTC, halved from 6.25 BTC in April 2024, with the next halving expected in 2028. This process ensures the network’s security by making it computationally expensive to alter the blockchain, but it also consumes significant energy, leading to debates about its environmental impact. Mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain a block time of about 10 minutes, ensuring stability as more miners join or leave the network. Individual miners often join mining pools to increase their chances of earning rewards, as solo mining with standard hardware is no longer viable due to the high computational power required.

Global Hashrate Distribution

The global distribution of Bitcoin’s mining hashrate—the total computational power securing the network—has become more decentralized in recent years, particularly after China’s 2021 mining ban.

Today’s Bitcoin hashrate is astronomically high (hundreds of exahashes/sec) and has generally trended upward as technology advanced. In practice, higher hashrate means greater security—an attacker would need to amass >50% of that power to conduct a double-spend, which is virtually impossible at current scale. Swan Bitcoin explains that as more miners join, network difficulty (and hashrate) rises, making attacks harder.

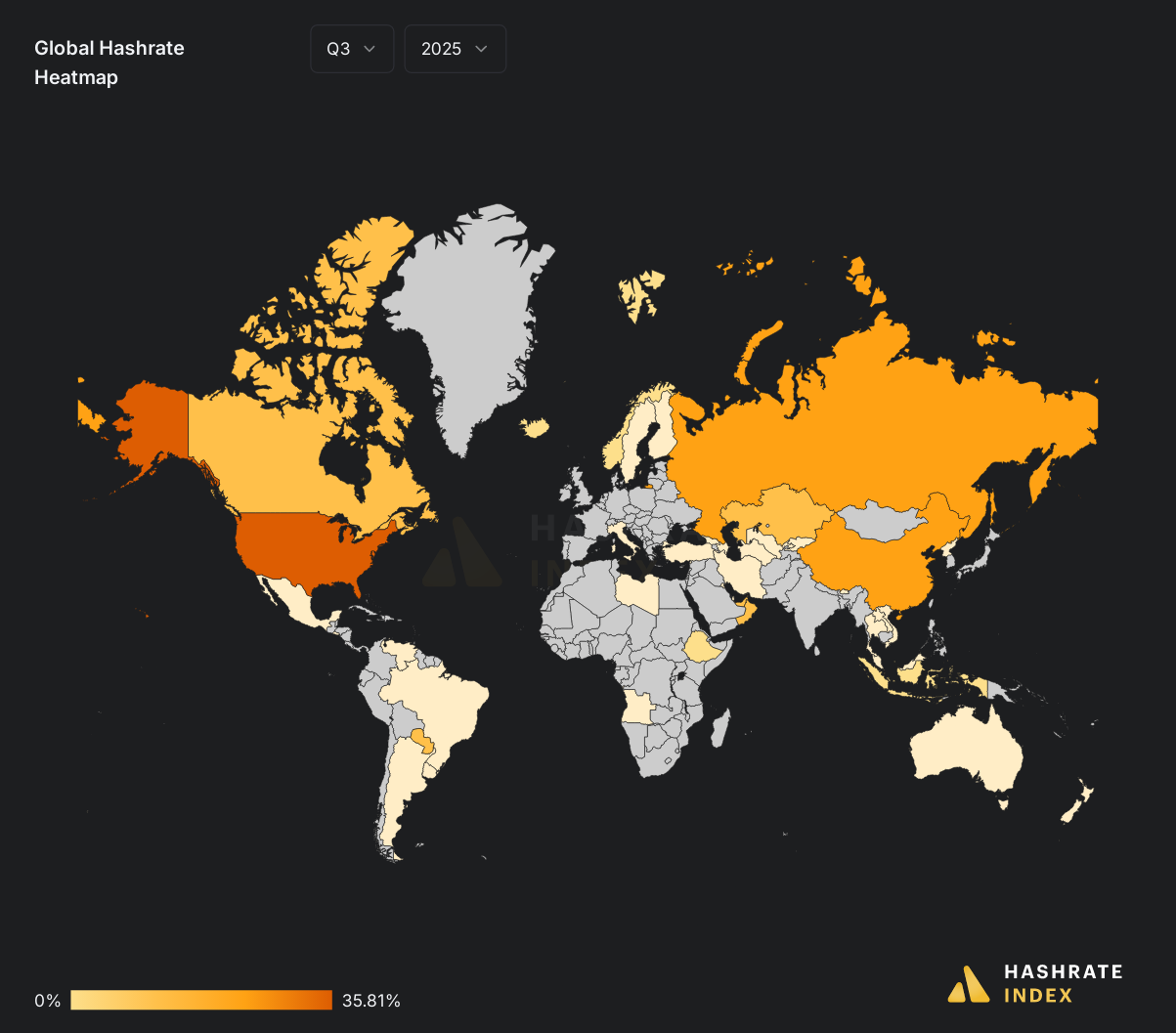

According to data from Hashrate Index (2025), the United States leads with approximately 36% of the global hashrate, driven by favourable regulations in states like Texas and Wyoming and access to renewable energy. Russia follows with 16%, leveraging its vast energy resources, while China, despite regulatory restrictions, still holds 14% through underground operations. Other notable contributors include Canada (3%), Paraguay (3.5%), the United Arab Emirates (3.75%), Ethiopia (1.5%), and Kazakhstan (2.5%). This distribution enhances network security by reducing the risk of a single entity controlling over 50% of the hashrate, which could enable a 51% attack.

Global Hashrate Heatmap

Below is a living heat map from Hashrate Index (Q2‑Q3 2025), reflecting the global distribution of mining power across nations. The U.S. clearly stand out in deep orange, with Russia, China, and Canada trailing:

Sustainability Efforts

Bitcoin mining’s energy consumption, estimated at 150 TWh annually in 2025, equivalent to a small nation’s energy use, has drawn significant scrutiny. The industry is responding with efforts to improve sustainability. Many miners are shifting to renewable energy sources, such as hydroelectric power in Canada and wind farms in Texas, to reduce their carbon footprint. For instance, platforms like MiningToken claim to use 100% renewable energy, including solar and hydroelectric sources, with AI-powered optimization to enhance efficiency. However, challenges persist, as some regions still rely on coal-powered facilities, contributing to a carbon footprint equivalent to burning 84 billion pounds of coal annually. Regulatory actions vary globally: Kuwait banned mining due to grid strain, while Iceland offers incentives for renewable-powered operations. Noise pollution from mining facilities, particularly in Texas, has also led to community backlash and lawsuits, prompting innovations like immersion cooling to mitigate disturbances. Experts suggest that regulatory interventions and technological advancements, such as more efficient Application-Specific Integrated Circuits (ASICs), are crucial for balancing efficiency with environmental concerns.

Global Bitcoin Mining Overview by Country

As we've seen, Bitcoin mining is globally distributed, with notable concentrations in a few key countries. This brief overview highlights how the major players engage with mining activity.

United States

The U.S. leads the world in Bitcoin hashrate, largely due to its access to renewable and stranded energy—including wind, solar, and flare gas from oil production. States like Texas and Wyoming offer favorable regulations and cheap power, making them hubs for mining infrastructure that aligns with environmental goals.

Canada

Canada’s mining sector is powered primarily by hydroelectric energy, making it one of the cleanest sources of Bitcoin in the world. With around 9% of the global hashrate, Canada is frequently cited as a model for sustainable, low-carbon mining operations.

Russia and Kazakhstan

These countries rely heavily on a mix of fossil fuels and hydropower, providing cheap electricity but raising sustainability concerns. The low cost often comes at the expense of environmental impact, especially in coal-heavy regions.

China

Although China officially banned crypto mining in 2021, it continues to contribute an estimated 13–14% of the global hashrate. Most of this comes from small-scale or covert mining operations, often concentrated in regions like Sichuan where hydropower is abundant during rainy seasons. However, the sustainability of these operations is variable and largely unregulated.

“The Chinese mining ban didn’t eliminate activity—it just pushed it underground. The use of renewable energy remains opportunistic and fragmented.”

— Alex de Vries, Founder of Digiconomist

| Country / Region | Est. Hashrate Share | Primary Energy Source(s) | Regulatory Environment | Key Characteristics / Notes |

|---|---|---|---|---|

| United States | 35–40% | Mix of fossil fuels & renewables | Generally permissive; varies by state | Home to Foundry USA and MARA Pool; largest mining infrastructure globally; benefits from private capital and access to energy markets. |

| Russia | ~16% | Natural gas (flare gas), hydro | Supportive, especially in Siberia | Cold climate and stranded energy make it a cost-effective region; increased mining post-2022 due to energy reallocation. |

| China | ~14% | Hydropower (seasonal), coal | Official ban since 2021, but tolerated regionally | Despite the ban, underground mining persists in provinces like Sichuan; often relies on off-grid or hidden operations. |

| Kazakhstan | 2.5–12% (varies) | Coal-heavy grid, some renewables | Tightening regulations; licensing required | Once a top 3 player post-China ban; recent power shortages and new taxes have reduced activity. |

| Canada | ~3–9% | Predominantly hydro | Supportive in some provinces (e.g. Quebec) | Clean, renewable energy and cold climate make it attractive; slower growth due to grid limitations. |

| UAE | ~3.75% | Natural gas, solar (growing) | Actively supportive, institutional focus | Strategic state-backed mining operations; aims to be a regional hub with regulatory clarity and infrastructure investment. |

| Paraguay | ~3.5% | Hydropower (Itaipu Dam) | Generally favorable | Abundant and cheap hydropower makes it ideal; attracting international miners seeking low-cost renewable energy. |

| Ethiopia | ~2.5% | 100% renewable (hydro, geothermal) | State-backed agreements; limited oversight | Africa’s largest contributor; benefits from excess renewable capacity and low costs; rapidly growing. |

| Norway | ~1.6% | Hydropower | Supportive, environmentally focused | Highly sustainable; tight environmental controls make it a model for green Bitcoin mining. |

Green Mining

Green mining refers to Bitcoin mining practices that aim to reduce environmental impact through energy efficiency and the use of sustainable energy sources. This emerging standard is increasingly important as environmental, social, and governance (ESG) concerns shape both public policy and institutional investment decisions.

Key characteristics of green mining include:

- Using renewable energy sources such as wind, solar, hydro, and geothermal.

- Capturing and reusing stranded or flare gas from oil fields to power off-grid mining.

- Deploying high-efficiency ASIC hardware and advanced cooling systems like immersion cooling.

- Locating operations near grid surpluses to avoid overloading electrical infrastructure.

- Participating in carbon offset programs or purchasing renewable energy credits.

As the Bitcoin ecosystem matures, green mining is becoming more than a niche—it’s a competitive advantage. Investors and governments are increasingly rewarding operations that align with global sustainability goals.

In conclusion, Bitcoin mining remains a cornerstone of the cryptocurrency’s ecosystem, securing the network through decentralized computation while rewarding miners with newly minted coins. As the industry evolves with advancements in hardware, energy efficiency, and regulatory frameworks, mining continues to balance economic incentives with environmental and technological challenges.

While mining anchors Bitcoin’s security through decentralized computation, its global distribution also reflects the shifting geopolitical and economic stakes tied to the network. But beyond hashpower and nodes lies another force shaping Bitcoin’s trajectory: institutional capital.

As traditional finance steps deeper into the Bitcoin arena, new instruments like ETFs, treasury allocations, and custody solutions are transforming how the asset is perceived, held, and regulated. In this next lesson, Institutional Instruments: Spot ETFs, Custody Solutions and Corporate Treasuries, we’ll examine how these institutional tools are reshaping Bitcoin’s role in global markets.