9.1 Non-Fungible Tokens (NFTs) and Use-Cases Beyond Art

NFTs (non-fungible tokens) have captured global attention since their emergence in the late 2010s. While they are often misunderstood as little more than expensive digital images or internet memes, NFTs represent a groundbreaking way to verify ownership, authenticity, and provenance of digital (and even physical) assets on a blockchain.

At their core, NFTs are unique digital tokens stored on a blockchain—a decentralized, tamper-resistant ledger that publicly and securely records transactions. Unlike fungible tokens such as cryptocurrencies (e.g. Bitcoin or Ethereum), where each unit is interchangeable and identical in value, non-fungible tokens are inherently distinct. Each NFT carries unique identifying information, making it impossible to exchange one-for-one with another.

To illustrate this difference: a dollar bill is fungible—any one is the same as another. But a concert ticket is non-fungible—it includes specific details like event name, date, time, and seat number that make it unique. NFTs function similarly, with unique metadata tied to each token.

The concept of non-fungible digital assets dates back to early blockchain experiments, such as Bitcoin’s Colored Coins (2012), which attempted to represent real-world assets using minimal metadata on the Bitcoin network. However, NFTs began gaining real traction with the launch of CryptoKitties in 2017—a blockchain-based game where users could buy, breed, and trade unique digital cats on Ethereum. This project demonstrated how smart contracts could power dynamic, interactive digital assets.

By 2021, NFTs had entered the mainstream, with total sales volume reaching billions of dollars. One landmark moment came when digital artist Beeple sold an NFT collage titled Everydays: The First 5000 Days at Christie’s for over $69 million—a record-setting event that helped solidify NFTs’ place in both the art world and the broader digital economy.

As of 2025, the NFT ecosystem continues to evolve. While speculative hype has cooled, NFTs are now being used in increasingly practical and diverse applications—including digital identity, ticketing, intellectual property management, in-game economies, music rights, real estate tokenization, and more. With programmable features and verifiable scarcity, NFTs offer a powerful new framework for owning and interacting with digital content across industries.

How NFTs Work

To understand NFTs (non-fungible tokens), it's important to look at the underlying technology and how digital assets are turned into verifiable, ownable tokens on a blockchain.

Minting is the process by which a digital file or asset—such as an image, video, or 3D model—is tokenized, meaning it is associated with a unique token on a blockchain. During minting, a smart contract (a self-executing program on the blockchain) generates a token ID and links it to a piece of metadata that describes the asset. This metadata typically includes information like the creator’s name, the creation date, traits, and a pointer (URI) to the actual digital file.

Because blockchain storage is expensive and limited, the media file itself is not stored on-chain. Instead, the metadata usually contains a link to a file stored off-chain on decentralized systems like IPFS (InterPlanetary File System), which helps ensure availability and integrity without relying on centralized servers.

On the Ethereum blockchain, most NFTs follow standards such as ERC‑721 (for fully unique tokens) or ERC‑1155 (which supports both fungible and non-fungible assets in a more efficient, batch-friendly format). These standards define how NFTs behave and interact with wallets, marketplaces, and other decentralized applications.

Once minted, the NFT’s ownership and transaction history are recorded immutably on the blockchain. This public ledger allows anyone to verify the authenticity and provenance of the token without needing a central authority.

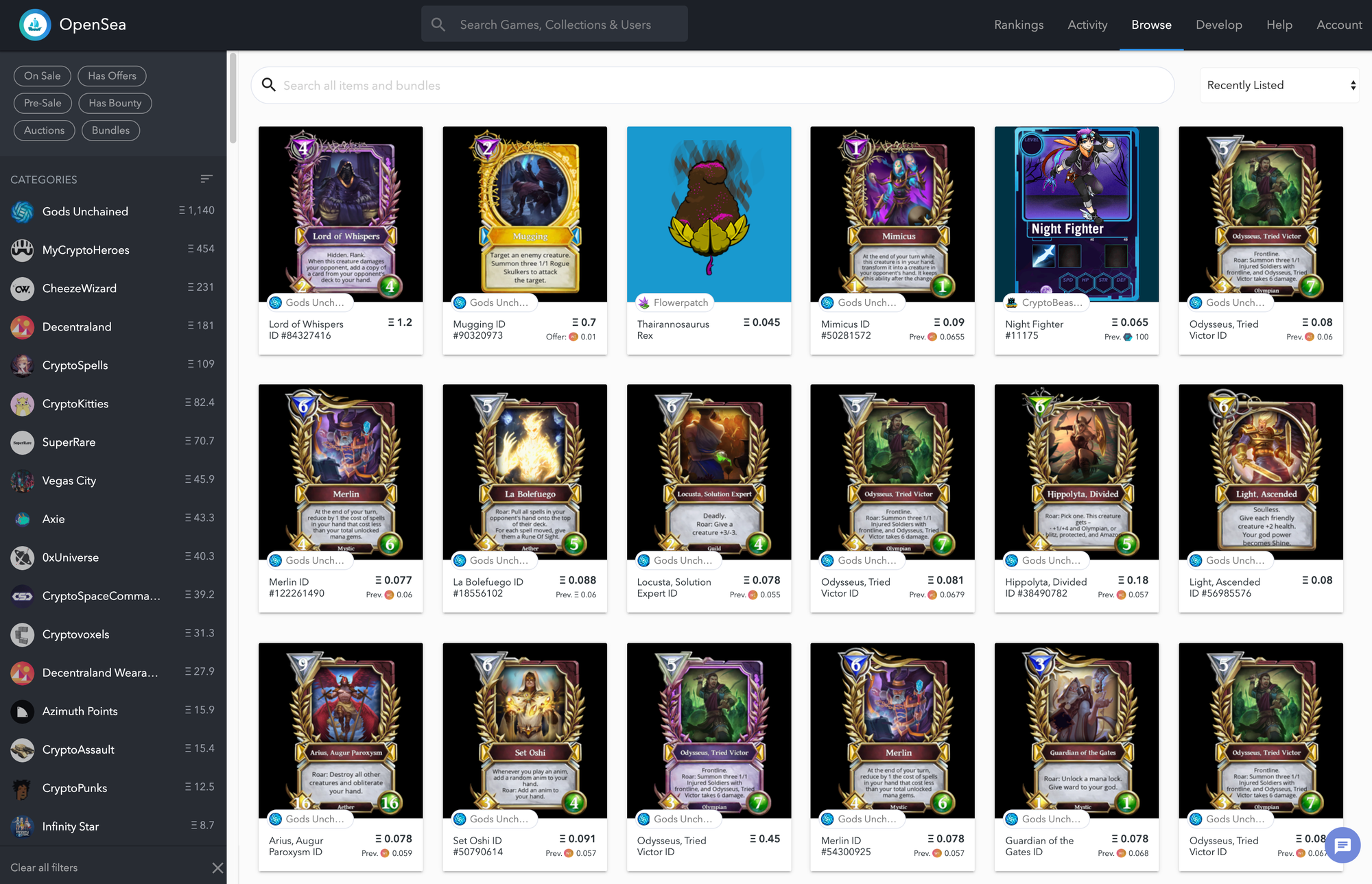

When someone purchases an NFT through a marketplace like OpenSea, the transaction is executed via the blockchain’s smart contract, which transfers ownership of the token and records it permanently. Payment is typically made in cryptocurrency (e.g. ETH or SOL), depending on the blockchain used.

NFTs can also be programmed to include royalty logic, allowing creators to automatically receive a percentage of any future resale (e.g. 10%). However, whether royalties are enforced depends on the platform or marketplace. Some honor them based on standards like ERC‑2981, while others do not, unless enforced by more advanced or custom smart contract mechanisms.

The programmability of NFTs—the ability to embed logic, metadata, and conditional behaviors—gives them functionality far beyond digital collectibles. They can represent access passes, in-game assets, digital credentials, and more, depending on how the smart contract is designed.

While Ethereum remains the most widely used blockchain for NFTs, other blockchains like Solana, Polygon, Flow, and Hedera offer alternatives with lower fees and faster transactions. Each has its own NFT standards and ecosystem practices.

A Quick Look at NFTs in Art and Collectibles

While this lesson focuses on the broader applications of NFTs, it's helpful to begin with their roots in digital art and collectibles—where they first gained mainstream traction.

In the realm of digital art, NFTs offer a solution to a long-standing challenge: how to create verifiable scarcity and authenticity in an environment where files can be endlessly copied. By minting a work of art as an NFT, creators can establish a unique, on-chain record of authorship and ownership, giving collectors the ability to claim the “original” version—complete with transparent provenance and transaction history.

Iconic early projects like CryptoPunks (10,000 algorithmically generated pixel characters) and Bored Ape Yacht Club helped define this space. These NFTs became more than just collectibles—they served as digital identities, status symbols, and membership tokens, granting holders access to private communities, events, and other perks.

The collectibles market expanded beyond art into areas like sports, gaming, and entertainment. One notable example is NBA Top Shot, a platform that offers blockchain-based trading cards in the form of officially licensed video highlight clips. These digital collectibles blend nostalgia with blockchain-backed ownership, opening new revenue streams for leagues and new engagement formats for fans.

While art and collectibles played a vital role in popularizing NFTs, they represent just the beginning. As we’ll explore, the underlying technology has far-reaching implications for industries ranging from finance to education, real estate, identity, and beyond.

Use Cases Beyond Art

NFTs are not limited to visuals; their ability to represent unique ownership opens up practical applications in everyday industries. Below, we'll explore key areas, with real-world examples to illustrate their impact.

Gaming and Virtual Economies

Gaming remains one of the most dynamic arenas for NFTs. Players now genuinely own in‑game assets—characters, weapons, land parcels—that they can buy, sell, or trade as NFTs, rather than items locked to a single game or platform. In games like Axie Infinity, users can breed, battle, upgrade (via recent evolution systems), and eventually trade their Axies (NFTs) for rewards and tokens. Virtual worlds such as Decentraland and The Sandbox extend this model to virtual real estate: players purchase land parcels as NFTs, build experiences (events, art galleries, social spaces), and sometimes even rent out space. While the vision of interoperable metaverses—where an item from one game can be used in another—is compelling and supported by some platforms, full interoperability remains a work in progress. Moreover, the P2E model is under pressure: token value volatility, declining user engagement in some titles, and lower earnings for casual players mean that sustainability is now a key challenge.

Music and Entertainment

In music, NFTs have enabled artists to bypass traditional labels, giving them the ability to tokenize tracks, albums, and exclusive content directly. Fans purchase these NFTs not only for ownership rights but also for access to royalties, exclusive experiences, or perks such as backstage passes. Kings of Leon were early pioneers in this space, releasing their album as NFTs in 2021, which included variants offering lifetime concert tickets or limited-edition vinyl. This groundbreaking move set a precedent for other musicians.

Platforms like Sound.xyz now allow artists to mint limited-edition songs and tracks as NFTs. These NFTs come with smart contracts that automatically split royalties between creators, providing an automated, transparent revenue model. This approach ensures that musicians earn from secondary market sales whenever their work is resold, which contrasts with the traditional music industry where royalties from resales typically don’t reach artists.

Beyond just music, NFTs have expanded into broader entertainment, including video clips, memes, and exclusive fan content. Additionally, NFTs have introduced new ways for creators to engage directly with their audiences. Social tokens and community-driven NFTs allow influencers and content creators to sell NFTs for exclusive interactions or voting rights within a fan community, thereby fostering a deeper sense of connection and collaboration.

Real Estate and Physical Assets

NFTs are transforming the way real estate and high-value physical goods are bought, sold, and managed. By tokenizing property deeds and ownership rights, NFTs allow for faster, more transparent property transfers without the traditional friction of lengthy paperwork or intermediaries. Platforms like Propy are at the forefront, leveraging blockchain to power decentralized title registries, enabling secure and tamper-proof records that reduce fraud and simplify closings.

A major innovation in this space is fractional ownership. Through NFTs, expensive assets like real estate, yachts, or even commercial properties can be divided into multiple tokenized shares, enabling smaller investors to own fractions of these high-value assets. This democratizes access to traditionally exclusive markets. Platforms like RealT continue to lead in this model, offering fractionalized real estate ownership where each property is represented by tokenized shares, with revenue distributed as tokenized rent payments.

The utility of NFTs also extends to physical goods, especially in luxury sectors. NFTs can act as digital certificates of authenticity and provenance for items such as designer watches, handbags, fine art, and wine. For instance, Ernst & Young (EY) has developed NFT-backed solutions for fine wine investors, allowing them to track origin, storage conditions, and transfer ownership seamlessly. These solutions not only combat counterfeiting but also provide a trusted way to verify the history and value of an item.

As the technology matures, expect increased adoption of NFTs in property registries, logistics, and luxury goods verification—especially in industries where trust, provenance, and authentication are paramount.

Ticketing and Access Control

NFTs are transforming ticketing and access control by offering programmable, secure, and verifiable solutions that reduce fraud, limit scalping, and enhance fan engagement. Through smart contracts, NFTs can enforce rules like resale price caps, automatic royalty payments, and limits on transfers, ensuring tickets are used fairly while benefiting event organizers. Post-event, NFTs can evolve into digital collectibles, unlock future access, or serve as membership tokens for exclusive communities. These digital assets not only act as tickets but also as dynamic tools for deeper fan interaction and loyalty.

Platforms like SeatlabNFT and GET Protocol have pioneered NFT-based ticketing that integrates resale restrictions, offering transparency and protection against fraud. Additionally, major brands like Nike’s Cryptokicks iRL and loyalty programs such as Starbucks Odyssey highlight the evolving use of NFTs beyond just ticketing—combining physical goods, digital collectibles, and community engagement. However, adoption is still in its early stages, with legal frameworks and user friction presenting ongoing challenges. As ticketing systems continue to mature, NFTs offer the potential to reshape event access and fan experiences in meaningful ways.

Supply Chain and Product Authenticity

Blockchain technology is increasingly being used in supply chains to enhance transparency, traceability, and product authenticity. By recording key events and data on a tamper-resistant ledger, blockchain systems can track the journey of goods from origin to end consumer, supporting verification and reducing fraud.

For example, IBM Food Trust—a blockchain network built on Hyperledger Fabric—uses its Trace module to follow the lifecycle of food products. This system captures and records information such as product origin, facility handling, shipment events, and associated metadata like timestamps and identifiers. While quality-related data (e.g. temperature or spoilage) can also be tracked, this requires integration with external sensors or data inputs. The platform enables authorized participants in the supply chain to query this information, supporting food safety, compliance, and accountability.

Meanwhile, SUKU’s INFINITE platform, now operating on the Hedera Hashgraph network, focuses on verifying the authenticity of high-value consumer goods such as limited-edition sneakers. INFINITE utilizes NFC-enabled tags, discreetly embedded inside the toe area of each shoe, which link the physical item to a unique digital title recorded on the blockchain. This system allows for real-time verification of authenticity, supports ownership transfers, and helps combat counterfeiting. Each tag serves as a tamper-evident identifier, enabling brands and consumers to trace the full lifecycle of the product, including resale.

Together, these blockchain-based solutions illustrate how decentralized technologies are reshaping the management of supply chains and authentication of goods, from food safety to luxury retail.

Digital Identity, Credentials, and Intellectual Property

NFTs and blockchain-based credentials are increasingly being applied to digital identity, academic verification, and intellectual property (IP) management. These systems offer improved verifiability, portability, and automation compared to traditional centralized models.

Verifiable Credentials and Academic Records

Blockchain-based credentials allow individuals to securely own, store, and share verifiable records—without relying on intermediaries.

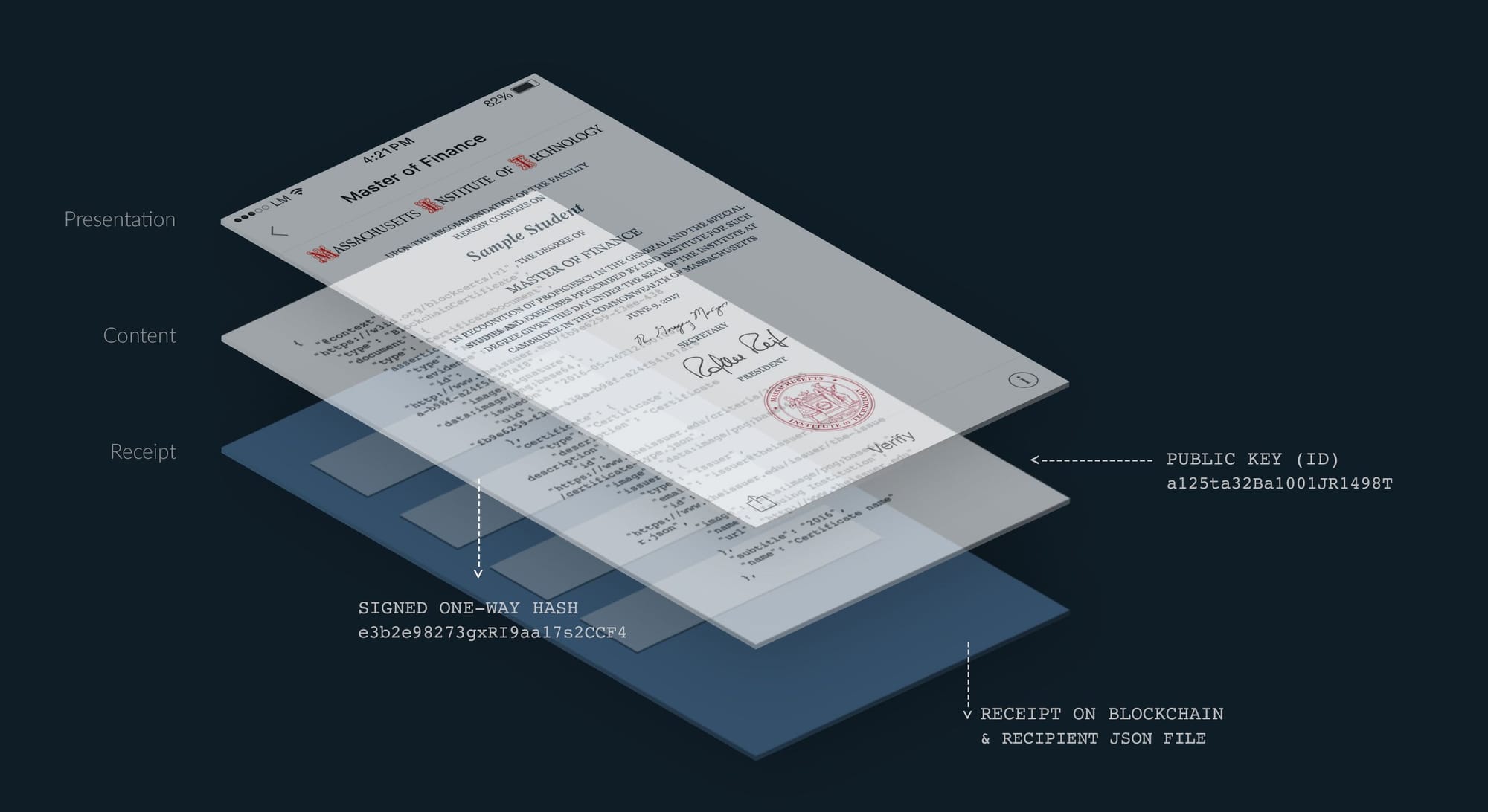

Example: MIT Digital Diplomas

The Massachusetts Institute of Technology (MIT) offers graduates the option to receive blockchain-certified diplomas through a system called Blockcerts—an open standard for issuing and verifying academic credentials on the blockchain.

- These digital diplomas can be independently verified for authenticity, issuance date, and ownership, without needing to contact the institution directly.

- This gives graduates control and portability, allowing them to share credentials with employers, licensing boards, or other universities on demand.

This model is being piloted or implemented by universities, certification bodies, and even governments worldwide, reducing credential fraud and administrative overhead.

Intellectual Property, Licensing and Royalties

NFTs also introduce new mechanisms for handling intellectual property rights and licensing.

Using smart contracts, NFTs can be programmed to automatically distribute royalties or licensing fees upon resale or usage. This is already standard practice on many NFT marketplaces, where creators can receive a percentage of every secondary sale (e.g. 5% or 10%), depending on platform rules and contract design.

However, purchasing an NFT does not automatically transfer copyright, patent, or other legal IP rights—unless explicitly stated in the terms of sale or smart contract:

- Typically, the underlying IP remains with the creator unless there is a separate legal agreement transferring ownership.

- Some NFT projects include usage licenses (e.g. commercial or non-commercial rights) encoded in metadata or referenced in smart contracts, but enforceability varies.

There is ongoing research into tokenizing IP assets themselves—such as patents, trademarks, or proprietary designs. Tokenization could enable:

- Transparent ownership records

- Fractional ownership or revenue-sharing models

- Automated licensing workflows

However, legal, regulatory, and interoperability challenges still limit full-scale implementation.

Decentralized Domains and Human-Readable Identities

Blockchain systems also support decentralized identity and naming services, which simplify user interaction with Web3 platforms.

Example: Ethereum Name Service (ENS)

ENS allows users to register human-readable domain names like Lucy.eth, which can map to:

- Ethereum wallet addresses

- Content hashes (e.g. IPFS)

- Decentralized websites

- Social media links

- Smart contract addresses

ENS domains are themselves NFTs (based on the ERC‑721 standard), which means they can be owned, traded, and transferred like any other token.

Additional features include:

- Reverse resolution (mapping a wallet address back to a name)

- Multi-record support (for storing multiple address types, metadata, etc.)

- Integration with traditional domains (e.g.

.com,.org) via DNS-ENS bridging

ENS is part of a broader trend toward decentralized identity—giving individuals full control over their digital identifiers without depending on centralized platforms.

Governance, Finance, and Other Innovations

As of 2025, NFTs are driving innovation across governance, finance, healthcare, and ownership, moving from experimental concepts to real-world implementations. These applications leverage blockchain's transparency and automation while facing evolving legal, regulatory, and adoption challenges.

DAO Governance and On-Chain Credentials

Decentralized Autonomous Organizations (DAOs) are increasingly using NFTs and non-transferable badges to assign roles, verify membership, or reward participation. These credentials may include traits that affect voting power, resource access, or community privileges.

Platforms like Snapshot integrate these NFTs into off-chain voting mechanisms, allowing attribute-based governance without centralized control. While the ecosystem is still evolving, this trend supports more transparent and verifiable DAO participation.

NFTs in Finance and Insurance

Tokenization is streamlining financial processes, especially in insurance and DeFi:

- Insurance: Etherisc’s FlightDelay product uses smart contracts and Chainlink oracles on Gnosis Chain to automate flight insurance payouts based on real-time data. Users purchase coverage in USDC, and eligible claims are settled instantly—no paperwork, no intermediaries.

- Collateralized Loans: Platforms like NFTfi, Arcade, and BendDAO allow users to borrow against high-value NFTs (e.g. CryptoPunks, Bored Apes). Loans are issued in stablecoins like USDC or ETH, with some protocols enabling fractionalized or tradable debt NFTs. These services offer liquidity without requiring asset sales but operate in a legal grey area—especially as regulators like the SEC scrutinize fractional NFTs for securities compliance.

Soulbound Tokens (SBTs) for Health Data

Soulbound Tokens (SBTs) are non-transferable NFTs designed for sensitive personal data such as electronic health records (EHRs). A 2025 academic framework uses ERC-721A and IPFS to:

- Store encrypted health data off-chain

- Batch-mint SBTs efficiently on-chain

- Allow patients to control access while maintaining data privacy

This approach supports compliance with HIPAA and similar regulations by ensuring records are verifiable yet non-transferable, reducing fraud and improving patient autonomy.

Vehicle Ownership and Blockchain Titles

Governments are piloting NFTs for physical asset ownership:

- In California, the DMV has digitized over 42 million vehicle titles on the Avalanche blockchain, enabling near-instant transfers via a secure app. Smart contracts support lien tracking and provenance, reducing fraud and bureaucracy. This pilot aligns with California’s blockchain executive order and could extend into DeFi use cases (e.g. car titles as loan collateral).

- Emerging projects like UNICAR tokenize vehicle details (e.g. VIN, model) into NFTs to serve as tamper-resistant global certificates for registration and resale. Based on early pilots and ETHGlobal showcases, these innovations aim to simplify cross-border verification and reduce title forgery.

Regulatory and Legal Considerations

Adoption depends heavily on legal recognition and privacy compliance:

- In the U.S., California treats NFT-based titles as legally binding, while enforcement for SBTs or NFT-backed loans remains inconsistent elsewhere.

- Privacy laws like GDPR and HIPAA restrict on-chain data storage, prompting widespread use of off-chain storage (e.g. IPFS) and encryption.

- In DeFi, the SEC is closely monitoring fractional NFTs and loan-backed tokens for possible classification as securities, pushing some platforms to register as broker-dealers.

Governments and agencies like USPTO and FinCEN are gradually updating IP and AML frameworks. As regulation matures in 2025 and beyond, clearer policies are expected to support innovation while ensuring consumer protection and legal enforceability.

Benefits of NFTs

NFTs provide verifiable ownership and transparency, which helps reduce fraud and trust issues. They can cut out or reduce intermediaries by automating many functions via smart contracts. Fractionalization enables ownership of high‑value assets in smaller shares, improving access and opening up liquidity in secondary markets. Creators can embed resale royalties to receive ongoing income each time an NFT is sold. NFTs also help foster communities through membership, exclusive access, and shared ownership models. For businesses, NFTs unlock new revenue streams (e.g. licensing, loyalty programs, token‑gated services) and can improve efficiency through reduced paperwork, simpler provenance tracking, and secure, tamper‑proof registries.

Challenges and Considerations

Despite their potential, NFTs still face several hurdles. Market volatility remains high, with values of popular collections often swinging wildly. Though Ethereum’s shift to proof‑of‑stake in 2022 drastically reduced its energy usage (by roughly 99%), environmental concerns persist—especially on networks that still use proof‑of‑work or inefficient storage and metadata systems. Scams and fraud are widespread: fake projects, misleading claims, phishing attacks, and weak links between NFTs and their associated content (especially when stored off‑chain) make due diligence essential. Regulatory ambiguity is another major issue—many governments have yet to define how NFTs fit into existing legal frameworks, particularly around securities, taxation, and intellectual property. Finally, technical fragmentation and limited interoperability across blockchains, plus usability barriers for new users (wallets, fees, private key security), still limit broader mainstream adoption.

Future Outlook

As the NFT ecosystem matures, several trends are converging to push NFTs toward mainstream adoption. Fractional NFTs (F‑NFTs) are lowering the barriers to entry by allowing shared ownership and greater liquidity. Cross‑chain and interoperable protocols are enabling NFTs to move seamlessly between blockchains, unlocking broader market access and flexibility. Meanwhile, integration with AI, virtual/augmented reality, and metaverse environments promises more dynamic, interactive, and context‑aware NFTs. In parallel, DeFi composability will further embed NFTs into financial products and yield primitives. As regulatory regimes evolve and institutions enter, NFTs are increasingly poised to weave together digital and physical worlds in a more seamless, legally grounded fashion.

Conclusion

NFTs are more than just a passing trend—they represent a foundational shift in how we define, own, and transfer digital assets. Beyond digital art, we've explored how NFTs are reshaping industries like gaming, music, real estate, finance, and even healthcare. As a beginner, a great starting point is to explore reputable marketplaces like OpenSea or Rarible, and build a basic understanding of blockchain, wallets, and smart contracts. While the technology offers exciting opportunities for creativity, access, and innovation, it’s important to approach the space thoughtfully—do your research, verify sources, and treat speculative investments with caution.

Now that you understand what NFTs are, let’s explore where they’re bought, sold, and traded. In the next lesson, we’ll dive into NFT marketplaces—the digital platforms that power the NFT economy.