9.2 NFT Marketplaces

NFT marketplaces are specialized online platforms where users can discover, buy, sell, mint, and trade NFTs. These platforms act as digital hubs, connecting creators with buyers and facilitating transactions via blockchain technology. Unlike traditional crypto exchanges, which focus on fungible tokens, NFT marketplaces emphasize unique assets and often include features like auctions, fixed-price listings, and bidding systems to determine value through supply and demand.

Marketplaces operate on various blockchains to reduce fees and improve accessibility. For example, some support multi-chain functionality, allowing users to trade across Ethereum, Solana, Polygon, and others, which helps mitigate high gas fees associated with network congestion. They also incorporate tools for creators, such as gasless minting (where fees are deferred) or royalty settings, ensuring ongoing revenue from resales. In essence, these platforms democratize access to digital ownership, eliminating intermediaries and enabling global, peer-to-peer exchanges.

From an economic perspective, NFT marketplaces often feature primary markets for initial mints and secondary markets for resales. Research indicates that secondary markets can lower initial prices by encouraging more purchases, but they may reduce creator revenue if too many buyers opt for resales instead of new items. Platforms must balance commissions, consumer behavior, and blockchain costs to remain profitable, with policymakers increasingly focusing on regulations to protect users from high fees or conflicts of interest.

| Type | Description | Best For |

|---|---|---|

| Primary / Minting | Creators make and sell new NFTs, often in limited-time releases (drops). Example: OpenSea’s minting tools. | New artists, project launches |

| Secondary | Resale of owned NFTs between buyers and sellers. Example: OpenSea’s marketplace. | Collectors, traders |

| Curated / Specialized | Focus on specific genres (e.g. art, gaming) with approval for listings. Example: SuperRare for art. | Niche collectors, high-quality creators |

| Cross-Chain / Aggregator | Trade across blockchains (e.g. Ethereum, Solana) or combine listings from multiple platforms. Example: Blur’s aggregation. | Advanced users, multi-blockchain fans |

Popular NFT Marketplaces in 2025

As of 2025, the NFT marketplace landscape has evolved, with platforms competing on fees, user experience, and niche focus. OpenSea remains a dominant force, boasting an all-time trading volume exceeding $39.5 billion and supporting a wide array of blockchains like Ethereum, Polygon, Solana, and more. It's user-friendly for beginners, offering categories from art and collectibles to virtual worlds and domain names. Blur has surged in popularity among high-volume traders due to its 0% marketplace fee, advanced analytics, bulk buying tools, and NFT lending features, often flipping OpenSea in monthly volumes. Magic Eden leads on Solana, excelling in gaming NFTs with high listing volumes and no gas fees on certain integrations, making it ideal for blockchain games.

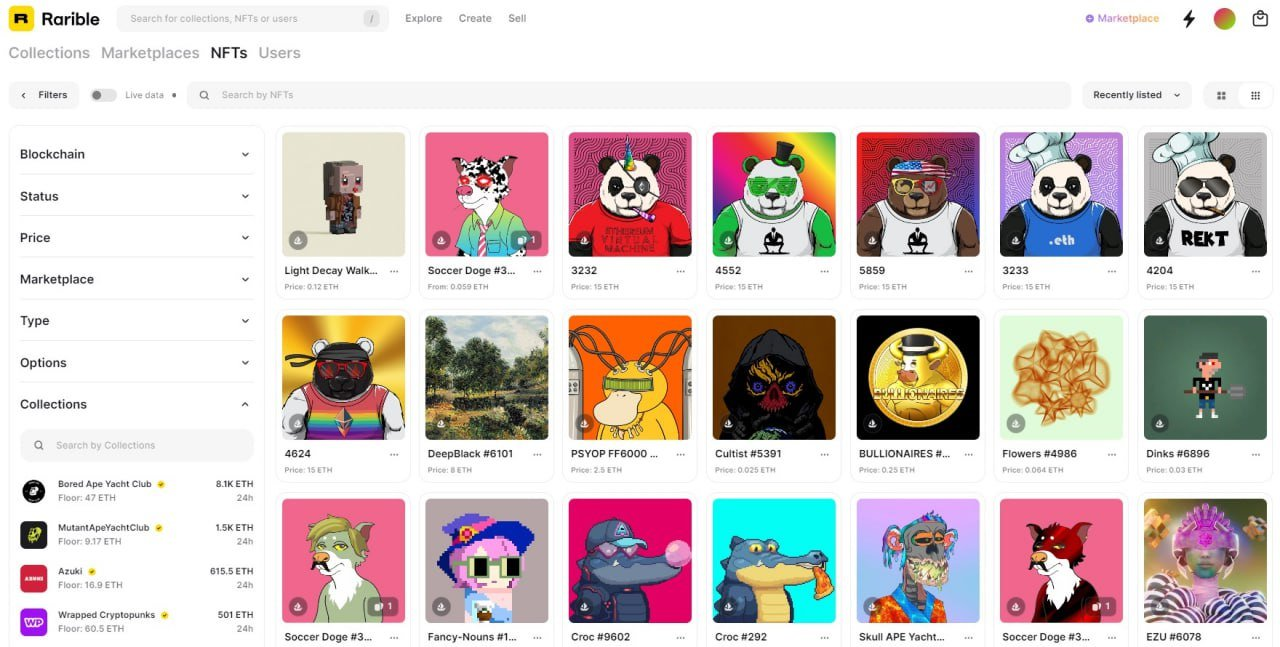

Rarible emphasizes community governance, with regressive fees (0.5%-7.5% based on sale price) and support for Ethereum, Solana, and Tezos. SuperRare focuses on curated digital art, featuring high-average prices (around $7,940 per NFT) and unique collector royalties that halve with each resale. Binance NFT offers low 1% transaction fees, mystery boxes, and integrations with gaming projects, appealing to users already in the Binance ecosystem. LooksRare attracts traders with reward incentives and lower fees, while Foundation and Zora cater to curated and open-protocol experiences, respectively.

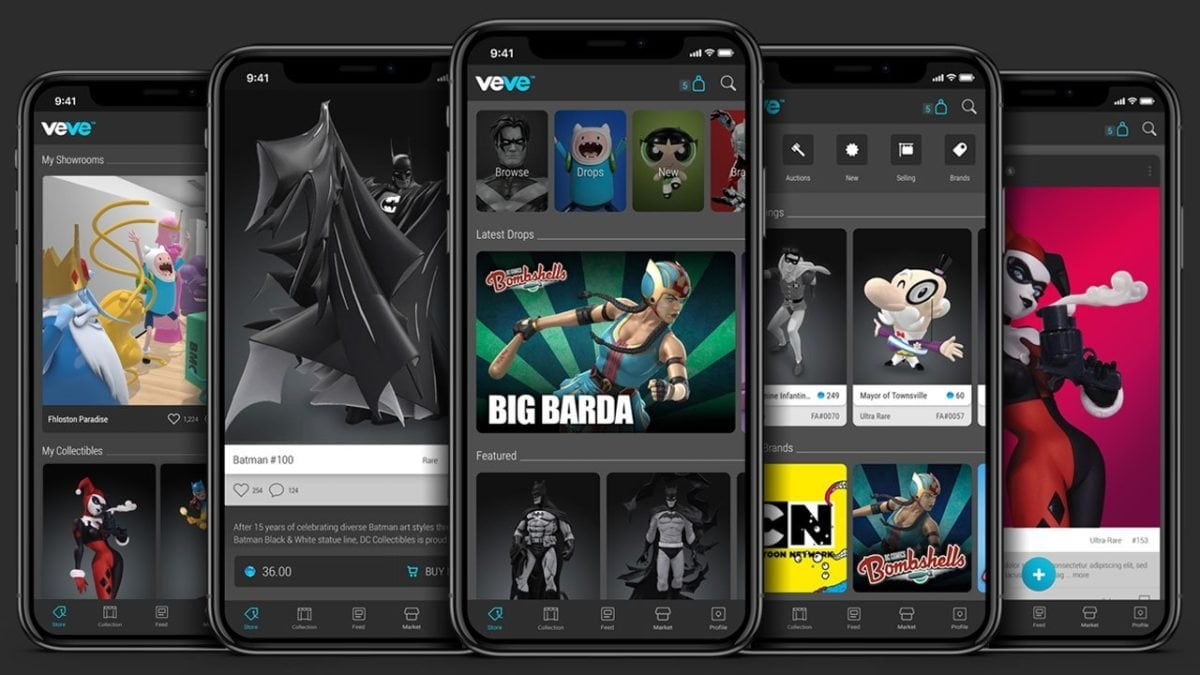

Niche platforms like VeVe specialize in branded collectibles from Disney and Marvel, with AR display features, and NBA Top Shot targets sports fans with licensed highlights on the Flow blockchain. Immutable X stands out for zero gas fees in gaming, and Mintable provides gasless minting backed by investors like Mark Cuban. Trends show a shift toward multi-chain support and sustainability, with over 80% of smart contracts now including automated royalties.

| Marketplace | Key Features | Supported Blockchains | Fees | Best For |

|---|---|---|---|---|

| OpenSea | Easy to use, supports many NFT types, huge selection | Ethereum, Polygon, Solana, others | 2.5% on resales, 2.5-10% on new sales | All users, art, collectibles |

| Blur | Tools for bulk buying, NFT loans, no platform fee | Ethereum | 0% platform fee | Advanced traders |

| Magic Eden | Gaming-focused, community-driven, no listing fees | Solana, Ethereum | Varies, 0% to list | Gamers, Solana fans |

| Rarible | Community-run, flexible fees based on sale price | Ethereum, Solana, Tezos | 0.5-7.5% | Decentralized art |

| SuperRare | Curated art, unique royalty system for collectors | Ethereum | Varies | High-end art collectors |

| Binance NFT | Low fees, mystery box events, gaming focus | Binance Smart Chain, Ethereum | 1% | Budget buyers, gamers |

| VeVe | AR displays, branded collectibles (Disney, Marvel) | Immutable X, others | Varies | Entertainment fans |

How to Buy NFTs on Marketplaces

Buying an NFT is straightforward but requires preparation.

- Set up a wallet

Use a compatible crypto wallet like MetaMask, Coinbase Wallet, Trust Wallet, or Kraken Wallet to store your crypto and NFTs. - Fund your wallet

Buy cryptocurrency (e.g. ETH for Ethereum NFTs) on an exchange like Coinbase, Binance, or Kraken, and transfer it to your wallet. Always double-check the network to avoid loss. - Choose a marketplace

Pick a platform (like OpenSea, Magic Eden, etc.), create an account if needed, and connect your wallet. - Browse and select

Explore NFTs listed at fixed prices or in auctions (timed or Dutch-style, where prices drop). - Buy or bid

Click "Buy Now" or place a bid, confirm the details, and approve the transaction—including gas fees. - Confirm ownership

After purchase, the NFT appears in your wallet. Verify ownership on a blockchain explorer if needed. - Primary mints

For early access to new projects, get whitelisted via official channels and mint at the scheduled time. - Be cautious

Peer-to-peer deals are riskier without marketplace protections. Always verify project authenticity and check whether metadata is stored on-chain or via IPFS for long-term security.

How to Sell or Mint NFTs

- Choose a marketplace

Use platforms like OpenSea, Mintable, or Rarible to mint your NFT. - Upload your file

Add your digital content (art, music, etc.), along with a name, description, and optional royalty percentage. - Mint the NFT

Review the details and confirm the minting. Pay gas fees—or use gasless minting if supported. - List for sale

After minting, choose a fixed price or auction format, set the terms, and list your NFT. - Sell an existing NFT

Go to your wallet or collection, click "Sell," define price and format, and publish the listing. - Understand fees and royalties

Marketplaces charge transaction fees, but you can earn royalties from future resales (providing passive income). - Resales and smart contracts

Secondary sales are common. Platforms use smart contracts to securely handle transfers and payments.

Risks and Safety Tips

NFTs carry risks like volatility, scams, and low liquidity—finding buyers can be tough if demand drops. Digital assets can be copied, and off-chain storage risks file loss if links break. High gas fees and environmental concerns also persist.

To stay safe, use reputable wallets and enable two-factor authentication. Research projects, avoid unsolicited offers, and store NFTs in cold wallets like Ledger for long-term holding. Understand intellectual property: owning an NFT doesn't always grant copyright. Diversify and only invest what you can afford to lose.

Trends and Future of NFT Marketplaces

In 2025, NFT marketplaces are integrating AI for dynamic, evolving tokens; DeFi for fractional ownership and staking; and gaming utilities for in-game assets. Real-world asset tokenization (e.g. real estate fractions) is rising, alongside multi-chain support to cut fees and sustainable practices like eco-friendly minting. Metaverse interoperability allows seamless trading of virtual land and avatars.

The future points to broader adoption, with regulations like India's 15% tax on trades influencing liquidity. As over 420 collections pledge sustainability, platforms will prioritize green tech and user protections, expanding NFTs beyond art into finance and experiences.

Now that you’re familiar with how NFTs are created, traded, and managed, it’s time to explore one of the core innovations driving Web3 communities forward: Decentralized Autonomous Organizations (DAOs). In the next lesson, we’ll introduce what DAOs are, how they work, and why they’re reshaping how decisions are made in digital ecosystems—from NFT projects to decentralized finance and beyond. You'll also learn how governance tokens give community members a real voice in shaping the future.